Books Of Account Type . as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. Here are the basic books that every taxpayer like you should keep in mind. Books of account are systematic records where businesses record their financial. what are books of account? What are the 6 books of accounts the bir requires to be. This book is referred to as the original entry book. 6 basic books of accounts: the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. types of accounting records include transactions, general ledgers, trial balances, journals, and financial statements. It records the transaction of the. 6 basic types of books of accounts.

from pioneeraccountinggroup.com

6 basic books of accounts: the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. What are the 6 books of accounts the bir requires to be. types of accounting records include transactions, general ledgers, trial balances, journals, and financial statements. It records the transaction of the. Here are the basic books that every taxpayer like you should keep in mind. what are books of account? Books of account are systematic records where businesses record their financial. as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. 6 basic types of books of accounts.

Startup Accounting Basics 6 Confusing Accounting Terms — Pioneer

Books Of Account Type 6 basic types of books of accounts. 6 basic books of accounts: the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. 6 basic types of books of accounts. what are books of account? Books of account are systematic records where businesses record their financial. types of accounting records include transactions, general ledgers, trial balances, journals, and financial statements. This book is referred to as the original entry book. as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. Here are the basic books that every taxpayer like you should keep in mind. What are the 6 books of accounts the bir requires to be. It records the transaction of the.

From www.patriotsoftware.com

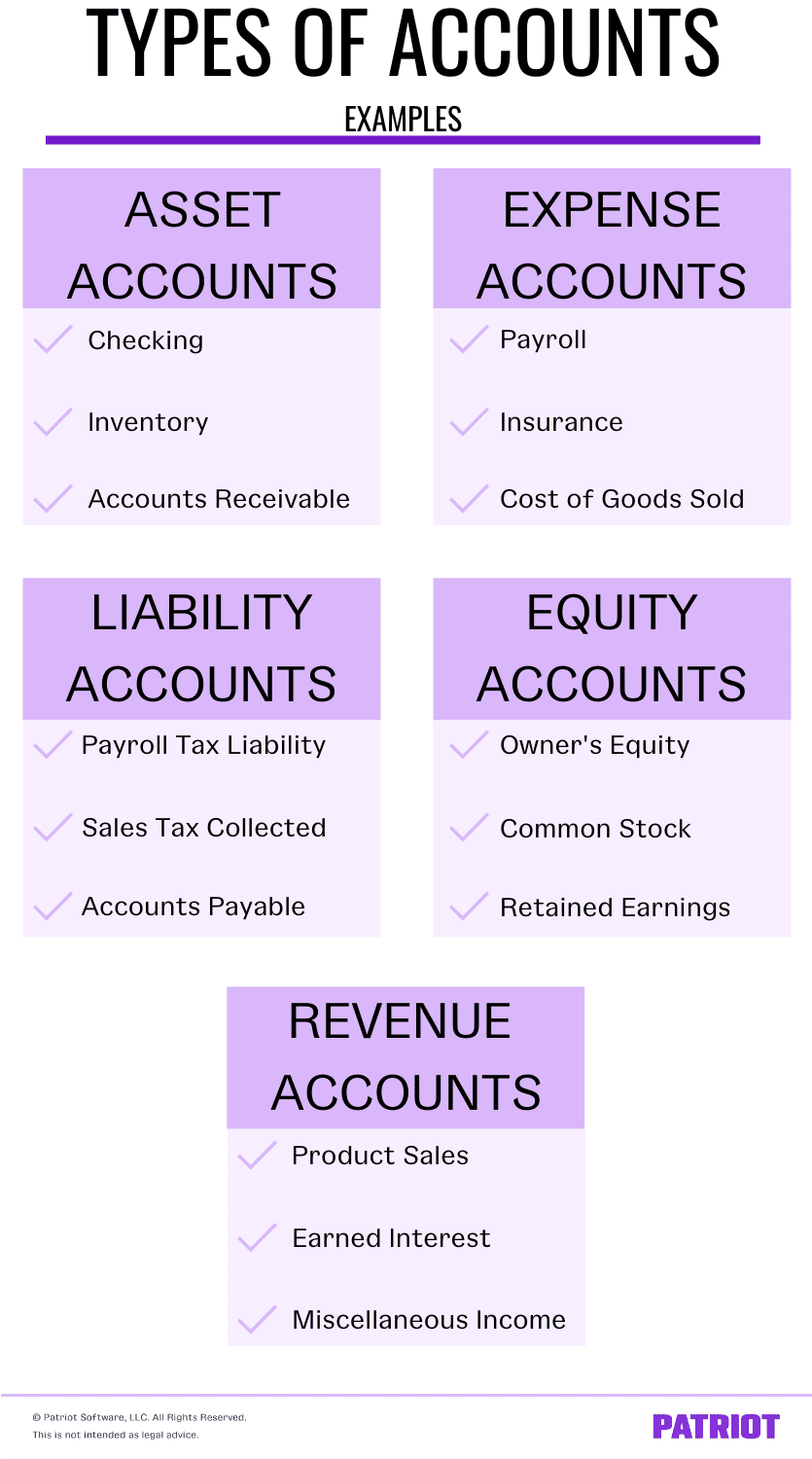

Types of Accounts in Accounting Assets, Expenses, & More Books Of Account Type 6 basic books of accounts: 6 basic types of books of accounts. This book is referred to as the original entry book. types of accounting records include transactions, general ledgers, trial balances, journals, and financial statements. what are books of account? It records the transaction of the. What are the 6 books of accounts the bir. Books Of Account Type.

From simp-link.com

Sample chart of accounts quickbooks Books Of Account Type 6 basic types of books of accounts. What are the 6 books of accounts the bir requires to be. the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. 6 basic books of accounts: as per bir guidelines, a registered taxpayer should choose between three. Books Of Account Type.

From filipiknow.net

Books of Accounts BIR Guide to Registration, Filling Up, and Record Books Of Account Type as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. This book is referred to as the original entry book. What are the 6 books of accounts the bir requires to be. the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash. Books Of Account Type.

From reliabooks.ph

What are the Books of Accounts? Books Of Account Type as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. This book is referred to as the original entry book. types of accounting records include transactions, general ledgers, trial balances, journals, and financial statements. Books of account are systematic records where businesses record their financial. what are books. Books Of Account Type.

From www.grantthornton.com.ph

Required online registration of books of accounts via ORUS Grant Thornton Books Of Account Type the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. Here are the basic books that every taxpayer like you should keep in mind. 6 basic types of books of accounts. Books of account are systematic records where businesses record their financial. what are books of. Books Of Account Type.

From www.iedunote.com

What is Accounting Ledger? Explained with Examples. Books Of Account Type as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. 6 basic types of books of accounts. Here are the basic books that every taxpayer like you should keep in mind. What are the 6 books of accounts the bir requires to be. Books of account are systematic records. Books Of Account Type.

From www.meruaccounting.com

How To Maintain Books of Accounts For Small Business? Books Of Account Type It records the transaction of the. what are books of account? What are the 6 books of accounts the bir requires to be. Books of account are systematic records where businesses record their financial. 6 basic books of accounts: as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of. Books Of Account Type.

From juan.tax

Formats of Books of Accounts Explained Books Of Account Type as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. Books of account are systematic records where businesses record their financial. It records the transaction of the. the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. . Books Of Account Type.

From www.dailymotion.com

QuickBooks Pro 2014 Tutorial Setting Up the Chart of Accounts Part 2 Books Of Account Type the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. what are books of account? as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. It records the transaction of the. What are the 6 books of. Books Of Account Type.

From charteredfinanceaccounts.blogspot.com

what are the 11 types of books of accounts? Books Of Account Type what are books of account? 6 basic books of accounts: as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. Here are the basic books that every taxpayer like you should keep in mind. the mandatory books of accounts that a business should maintain include the purchase. Books Of Account Type.

From simp-link.com

Sample chart of accounts quickbooks Books Of Account Type as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. 6 basic types of books of accounts. Books of account are systematic records where businesses record their financial. the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash. Books Of Account Type.

From www.facebook.com

Accounting Tutorial Center How to record your business transactions Books Of Account Type This book is referred to as the original entry book. What are the 6 books of accounts the bir requires to be. 6 basic books of accounts: Books of account are systematic records where businesses record their financial. the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash. Books Of Account Type.

From ar.inspiredpencil.com

Quickbooks Chart Of Accounts Excel Template Books Of Account Type the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. Books of account are systematic records where businesses record their financial. types of accounting records include transactions, general ledgers, trial balances, journals, and financial statements. 6 basic types of books of accounts. This book is referred. Books Of Account Type.

From www.accountancyknowledge.com

Books of Accounts Accountancy Knowledge Books Of Account Type as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. This book is referred to as the original entry book. What are the 6 books of accounts the bir requires to be. 6 basic books of accounts: Books of account are systematic records where businesses record their financial. . Books Of Account Type.

From www.erplybooks.com

Chart of Accounts in ERPLY Books ERPLY Books Accounting Software Books Of Account Type This book is referred to as the original entry book. Books of account are systematic records where businesses record their financial. the mandatory books of accounts that a business should maintain include the purchase journal, sales journal, cash receipt journal, cash disbursement. 6 basic books of accounts: 6 basic types of books of accounts. what are. Books Of Account Type.

From hvscurtish.blogspot.com

Books Of Accounts Bir How To Record In Your Books Of Accounts For Non Books Of Account Type Here are the basic books that every taxpayer like you should keep in mind. This book is referred to as the original entry book. what are books of account? Books of account are systematic records where businesses record their financial. It records the transaction of the. the mandatory books of accounts that a business should maintain include the. Books Of Account Type.

From jkbhardwaj.com

Golden Rules Of Accounting Class 11 Books Of Account Type as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. What are the 6 books of accounts the bir requires to be. This book is referred to as the original entry book. Here are the basic books that every taxpayer like you should keep in mind. the mandatory books. Books Of Account Type.

From juan.tax

3 Formats and 6 Basic Types of Books of Accounts Explained Books Of Account Type This book is referred to as the original entry book. Here are the basic books that every taxpayer like you should keep in mind. as per bir guidelines, a registered taxpayer should choose between three formats namely — (1) manual books of account,. It records the transaction of the. What are the 6 books of accounts the bir requires. Books Of Account Type.